Posted on Oct 23, 2025 |

Most insurance buyers begin their search online. Yet many agencies still rely on outdated marketing methods that worked decades ago. The market is experiencing a perceptible shift, and those ignoring it may lose ground to competitors who understand modern customer behavior.

Simply having a digital presence is not sufficient today. The first page of Google captures nearly all web traffic. Agencies must actively work to earn a top ranking and be discovered. They can no longer depend on reputation alone or assume word-of-mouth will bring customers. To keep growing, they need a smart insurance agency marketing strategy that combines digital reach with a genuine personal touch that sets them apart.

This blog explains how insurance agencies can build marketing strategies that drive results. It talks about the challenges agencies face, which digital channels deliver the best returns, and how to scale marketing for long-term growth.

Table of Contents

Insuring Your Success: A Guide to Crafting a Winning Insurance Agency Marketing Strategy

What Are the Current Marketing Challenges Insurance Agencies Face?

Which Digital Marketing Channels Deliver Maximum Impact for Insurance Agencies?

How Can Agencies Leverage Content Marketing to Build Trust and Authority?

How Can Insurers Scale Their Marketing for Long-Term Growth?

Conclusion

What Are the Current Marketing Challenges Insurance Agencies Face?

Insurance agencies are dealing with new challenges in today’s markets. Traditional marketing methods for insurance products are no longer effective, as customer priorities have shifted and competition is fiercer than ever.

1. Rising Customer Expectations

Today, insurance customers expect their experience to match what they get from digital companies everywhere. They want tailored advice and smooth end-to-end experiences. But customer journeys are generally fragmented. Most users switch channels before they complete a purchase. This puts huge pressure on agencies that want to keep their experiences consistent.

Even worse, customers prefer different channels for communication. While most people expect digital channels for routine services, very few report digital as their preferred medium for interacting with insurers. This creates a tricky situation for agencies trying to meet everyone’s needs.

2. Digital Disruption and Competition

InsurTech startups have grown incredibly fast. These new competitors use artificial intelligence, big data, and digital platforms to create smooth customer experiences that are difficult for traditional agencies to match.

InsurTechs employ usage-based insurance models to better understand customer behavior. This helps them set premiums that reflect actual risk. They also use quality data sources to pre-fill application details and reduce the time it takes to get a quote.

Traditional insurers face a fundamental disadvantage compared to InsurTechs. Their core systems are often outdated. This prevents them from delivering the connected and tailored experiences consumers now expect.

3. Regulatory and Compliance Concerns

Insurance marketing operates under some of the strictest rules in business. Agencies must balance creativity with strict legal requirements. Those working in multiple regions must navigate through different rules in each state. This turns simple marketing campaigns into complex projects that need legal review at every step.

Data privacy regulations add another layer of compliance. Rules like GDPR and data protection laws in US states require agencies to handle customer information carefully in any marketing communication. These requirements impede their ability to work smoothly and affect their responsiveness to new market opportunities.

4. Legacy Systems and Limited Digital Skills

Legacy systems are widely used in the insurance industry. Recent research tells us that 74% of insurance companies still rely on outdated technology for their core functions. What’s worse, a big part of their yearly budgets goes toward maintaining this old technology instead of innovating.

This reliance on older systems also creates a digital skills gap. With old infrastructure, employees lack exposure to new technologies. This prevents the development of critical internal expertise. This problem becomes worse as experienced staff retire, taking their institutional knowledge with them. It’s no surprise that only a small fraction of insurers get value from their tech initiatives.

AI in Digital Marketing: Why It’s Essential for Businesses Today

Which Digital Marketing Channels Deliver Maximum Impact for Insurance Agencies?

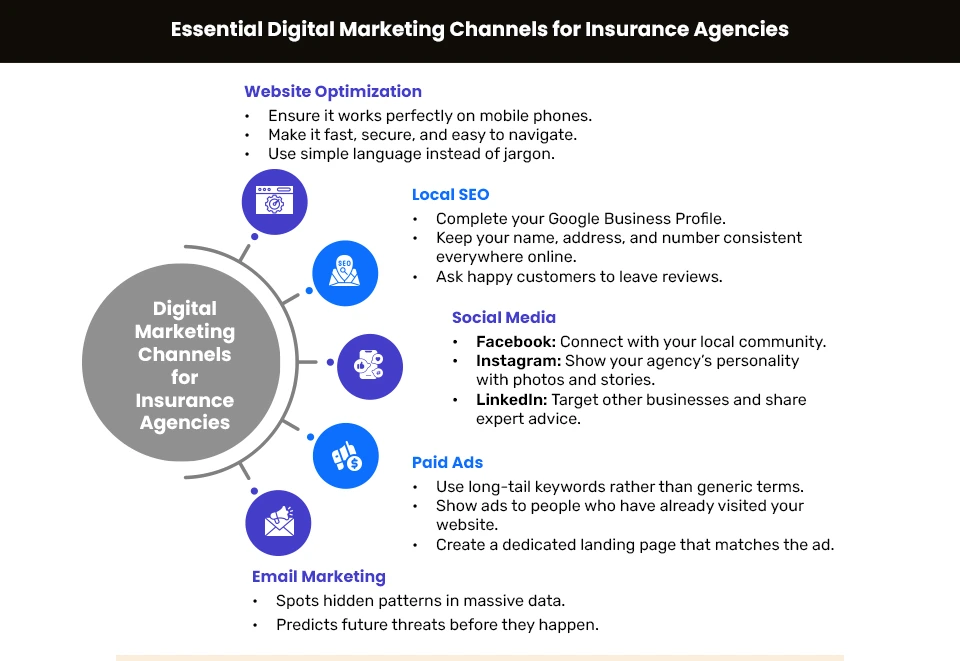

An effective digital marketing strategy for insurance companies involves picking the right channels. Not every channel works the same way for insurance, so agencies need platforms that bring the best return on investment.

I. Website Optimization

An agency’s website works like a marketing representative. It gives them a chance to create a lasting impression. Smart agencies emphasize mobile-first responsive design. This design automatically adjusts how content looks on different devices. The approach makes perfect sense since mobile devices now account for most of the insurance searches.

A great website needs more than just responsiveness. It should load fast, be easy to navigate, and use SSL encryption for security. Simple product pages that skip complex insurance jargon help visitors understand what is being offered. A website also needs regular updates to function smoothly.

II. Search Engine Optimization and Local Search

Local search results matter because most of the insurance searches happen locally. A solid local SEO strategy puts an agency front and center when potential customers look for ‘insurance agent near me.’

Successful local SEO depends on:

- Complete Google Business Profile with accurate information

- Same name, address, and phone number on all platforms

- Landing pages that target local keywords

- Backlinks from local businesses

Reviews also play a big role in local search rankings. Google Business profiles that show up in map pack results usually have high user ratings. That means every happy client should be asked for a review.

III. Social Media Engagement

Each social media platform gives insurance agencies a unique way to reach audiences. Their platform choice should match their business goals and target audience.

Facebook has over three billion active monthly users. It works great for community engagement. Instagram shines at visual storytelling and building brand identity, especially with younger audiences. LinkedIn works for B2B networking, authoritative content, and commercial insurance marketing.

Agencies that regularly share educational content, community involvement, and industry updates do well on social channels. The key lies in keeping the brand relatable and building credibility.

IV. Paid Campaigns for Targeted Lead Generation

PPC advertising puts insurance agencies in front of users right away, without waiting months for SEO results. Companies usually earn $2 for every $1 they spend on Google Ads, making it budget-friendly when managed well.

Smart paid campaigns include:

- Long-tail keywords like ‘life insurance agencies in Denver’ instead of broad terms

- Remarketing to attract past website visitors

- Custom landing pages that match ad messaging

- Regularly refreshed ad creatives

The campaign performance gets better when insurers track metrics like cost-per-click, click-through rates, and conversions. The data tells them what is working and what needs adjustment.

V. Email Marketing and Automation

Email marketing brings in $36 for every $1 spent, making it the marketing channel with one of the highest returns on investment. For insurance companies, email automation turns routine communications into lasting relationships.

With email automation, agencies can group audiences by location, policy type, or engagement level. These groups get tailored messages related to renewals and new policies. Automated messages for new clients, renewal reminders, and post-quote follow-ups offer chances to nurture leads over time. It’s not surprising that agencies that use these strategies consistently achieve better engagement and more conversions.

How Can Agencies Leverage Content Marketing to Build Trust and Authority?

“The only way to win at content marketing is for the reader to say, ‘This was written specifically for me.’”

Jamie Turner, Keynote Speaker and Consultant

Content marketing works differently for insurance agencies than for other businesses. People browse insurance content when they need answers to specific problems or want assurance about complex financial decisions. Insurers that create educational content attract more buyers.

1. Educational Blogs and Guides

Content that simplifies complex insurance terminology builds better connections with potential and existing customers. Agencies can create blogs to share updates, industry news, and service offerings while showcasing their expertise.

Educational blogs and guides should have:

- Content relevant to readers

- Right amount of detail

- Accurate information written in a professional tone

- Clear, conversational writing anyone can understand

Blog posts that answer genuine questions like ‘Is it cheaper to insure a new or used car?’ or ‘Can I get life insurance if I have a pre-existing condition?’ help agencies rank in searches and show prospects they understand their needs.

2. Video Marketing

Research shows that web pages with videos can increase conversion rates by 80%. But most agencies produce overly corporate videos that nobody watches. Keeping the videos simple and relatable changes how prospects perceive an agency.

These video types work well for insurers:

- FAQ videos answering common questions

- Team introductions that show people working in the agency

- Community involvement clips that showcase their values

3. Customer Success Stories

Trust has built the insurance industry, and testimonials prove it. Most consumers today read online reviews before making purchases. Websites that feature customer testimonials boost sales considerably.

Testimonials are critical, but generic praise is ineffective. Insurers need stories that show concrete results. A testimonial that details saving 15% on premiums or having a claim resolved within three hours demonstrates clear value that new prospects can desire for themselves.

Multi-Line Insurance Brokerage Firm Achieved a 21% Rise in Traffic After Website

How Can Insurers Scale Their Marketing for Long-Term Growth?

Technology continues to reshape the insurance landscape. Agencies must develop strategies that grow with their business. They should also pick technologies that drive actual results.

I. AI and Automation Adoption

AI can take over tasks that humans traditionally handle. This reduces the manual workload and frees up staff to focus on relationship building. Insurance agencies see significant productivity gains with AI-based assistants. Chatbots help customers with common policy queries. Agencies now trust generative AI tools for advice on business operations. Many use these tools to create tailored messages for policyholders and claimants.

That said, AI works best when it supports human expertise rather than replacing it. Future-centered agencies use these tools to handle routine tasks while their staff focuses on meeting complex client needs.

II. CRM Integration

An insurance CRM puts client information, policy details, and claims history in one easy-to-access place. Agents can get detailed information about each policyholder. This helps them provide personal service and build stronger relationships.

A reliable CRM system offers many features:

- Automated policy management and claims processing

- Customer communication tracking

- Real-time analysis for data-backed decisions

CRM systems eliminate data silos that slow down work. When everyone has access to the same client information, service improves, and opportunities are timely captured.

III. Omnichannel Consistency

Today’s customers switch effortlessly between digital and analog channels. To succeed, insurers must make all their channels work together smoothly. They need integrated systems that collect customer information consistently at every interaction.

Agencies that use omnichannel approaches show a genuine commitment to meeting customer needs. They recognize that winning new customers is as important as keeping current ones, and both need high-quality experiences across all channels.

How to Build a Sustainable Insurance Agency Marketing Strategy for Long-Term Growth?

| Strategy | What It Does | Benefit |

|---|---|---|

| AI and Automation | Uses tools like chatbots to handle simple questions and tasks. | Frees up staff time to focus on complex customer needs and build relationships. |

| CRM Integration | Puts all client data and history in one central, easy-to-access place. | Provides personalized service and ensures no opportunities are missed. |

| Omnichannel Consistency | Connects all customer touchpoints to work together smoothly. | Creates a smooth experience for new and existing customers across every channel. |

Conclusion

The rules of digital marketing for insurance agents have changed. Agencies that adapt will lead the industry. Those that do not will face pressure from InsurTechs and players that understand modern customer behavior.

Technology will continue reshaping insurance marketing. AI tools will get smarter. Customer expectations will keep rising. New platforms will also emerge. Agencies that embrace these changes will find themselves ahead of competitors who resist change.

The foundation of insurance has always been trust and relationships. Digital marketing does not change that fundamental truth. It offers new ways to build trust and stronger tools to maintain relationships. Agencies that remember this will write the next chapter of the insurance industry.